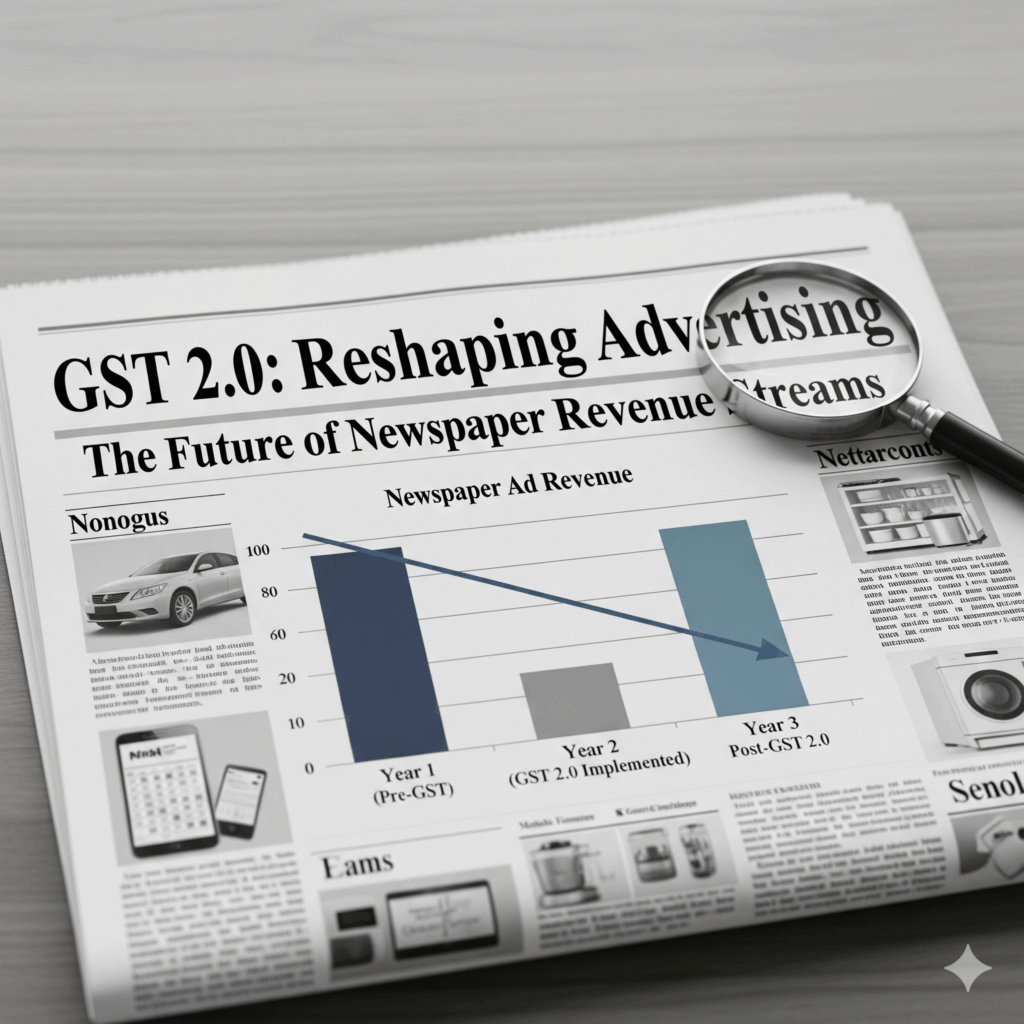

With the introduction of GST 2.0, businesses across India are preparing for a new wave of changes in pricing, taxation, and compliance. While the spotlight has been on goods and services like clothing, automobiles, and hospitality, one area that will also see an impact is newspaper advertising.

For brands and businesses that rely heavily on print media for visibility, it’s important to understand how GST 2.0 will affect ad rates and marketing budgets in newspapers—and how agencies like Get Me Up Advertising can help you optimize costs while maximizing reach.

📌 What Does GST 2.0 Mean for Newspaper Advertisers?

Under GST 2.0, ad agencies and publishers will align their tax structures with the updated framework. This will bring:

- Revised Tax Rates on Advertising Services

- The GST component on newspaper ad bookings may see adjustments.

- Businesses should be ready for minor cost shifts in classified, display, and tender notices.

- More Transparency in Billing

- A simplified GST structure ensures clearer invoices, reducing chances of hidden costs.

- Advertisers will know exactly what part of the bill goes to ad space and what part is tax.

- Impact on Marketing Budgets

- Companies may need to reallocate budgets to absorb changes in ad rates.

- Those who plan smartly can still maintain reach without overspending.

- Better Input Tax Credit (ITC) Utilization

- Businesses that qualify can claim ITC on newspaper advertising spend.

- This makes print media more cost-effective in the long run.

📊 Why GST 2.0 Could Actually Benefit Newspaper Advertising

While many see GST revisions as an added burden, there are potential benefits for advertisers:

- Standardization across regions: Uniform tax rates mean easier planning for national campaigns.

- Encouragement for transparent dealings: Genuine ad agencies and publishers stand out, reducing risks of fraud.

- Boost for long-term campaigns: Businesses can plan sustained ads with clear tax predictability.

In short, GST 2.0 could make newspaper advertising more structured, reliable, and efficient.

📰 Why Businesses Should Still Invest in Newspaper Ads

Even in the digital era, newspapers hold unmatched credibility. With GST 2.0’s transparency, print advertising remains a powerful medium for:

- Legal notices & public announcements

- Corporate branding & recruitment

- Tenders, government ads, and classifieds

- Regional visibility in tier-2 and tier-3 cities

✅ Why Choose Get Me Up Advertising?

As an authorised newspaper ad agency, Get Me Up Advertising helps businesses navigate the changing landscape of advertising under GST 2.0.

Here’s what we offer:

- Discounted newspaper ad rates across leading dailies (Times of India, Hindustan Times, Dainik Jagran, Amar Ujala, The Hindu, and more).

- Hassle-free GST-compliant billing with proper invoicing.

- Expert guidance on choosing the right editions and ad formats.

- Pan-India service with 98% customer satisfaction.

📞 Call us at 9810974532

✉️ Email: info@getmeup.in

🌐 Book your ad online: Get Me Up Advertising

🔑 Final Takeaway

GST 2.0 is not just a tax reform—it’s an opportunity to rethink and optimize your marketing budgets. By partnering with a trusted agency like Get Me Up Advertising, you can ensure that your newspaper advertising remains impactful, cost-efficient, and fully compliant with the new system.